Bitcoin sees immense volatility at $ 8,000 near mid-term: what analysts think

[ad_1]

Since our last market update, Bitcoin has continued to fall.

A few minutes ago, the main cryptocurrency reached $ 8,180 for the third time in the past two days. Since then, BTC has recovered from this level, indicating that this level is of some importance, going back to $ 8,450 at the time of writing.

Bitcoin price chart from TradingView.com

The initial settlement of Monday's highs of $ 9,200 to $ 8,500 resulted in settlements worth $ 20 million. This latest lower tranche of $ 8,500 to $ 8,100 has catalyzed other long position settlements worth $ 15 million on BitMEX, according to Skew.com data

As for the cause of the continuing decline, analysts are divided.

One trader proposed that it was a "coordinated" mass sale by miners, but data from the blockchain intelligence company ByteTree suggests that this is not the case. Instead, with falling funding rates, this could be a concerted attempt by short films to reduce the price.

Joe McCann, Microsoft's cloud and artificial intelligence specialist and one of the leading crypto dealers, commented on his Telegram channel about the crash:

"The lower impression (funding rate) on this blush, about half of the previous one … less time consuming to settle. So I think it could be a short-term capitulation fund."

Bitcoin has key levels

While the declines are not a bullish signal for Bitcoin, it is important to note that the episodes of bearish actions in the past two days have stopped in one key region: $ 8,000 to $ 8,200.

This is important for bulls, as analysts have explained, because this is where the 100 day and 200 day simple moving averages meet. These levels are considered technical turning points for the markets, including encryption.

Bitcoin price chart with the main moving averages of TradingView.com

$ 8,000 to $ 8,200 is also a range where there is a confluence of historic trend lines and horizontal resistance, adding even more credibility to the bullish feeling.

Analysts remain optimistic

Analysts are largely optimistic about Bitcoin's advancement from a short and medium term perspective, this leaves out.

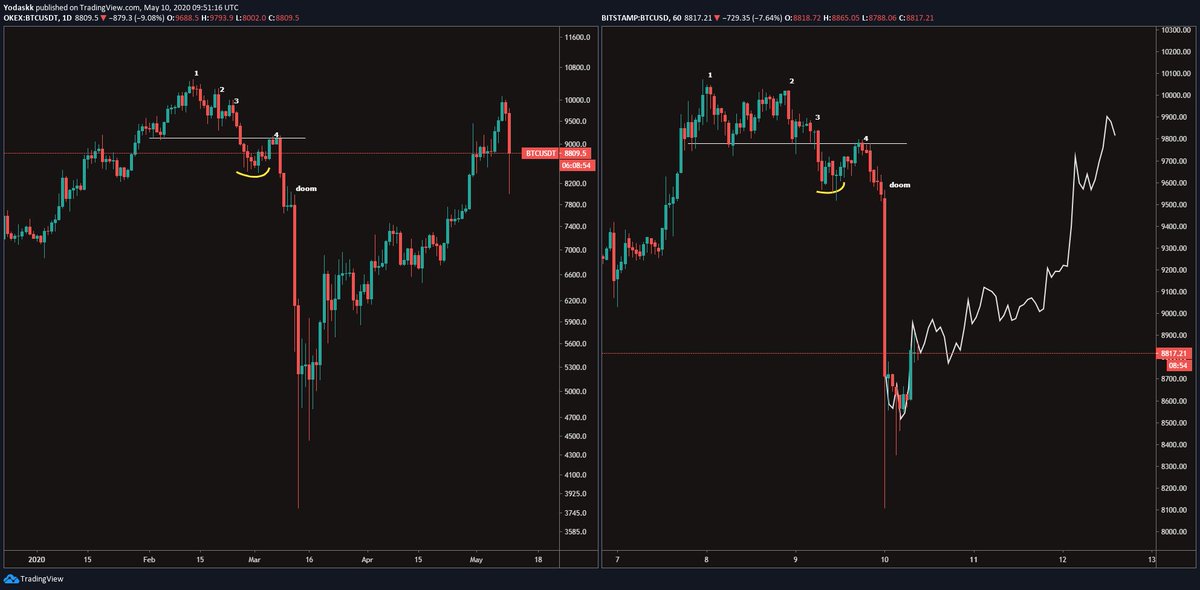

A popular merchant shared the table below, indicating that there are notable similarities between the action of Bitcoin prices for the whole of 2020 and that of the last three days: the two periods have a maximum distribution in four phases, a collapse of capitulation, then a rapid resumption of lows.

The full-fledged fractal, the trader suggested, will cause BTC to return to $ 10,000 in the next two to three days.

Chart from @Yodaskk (Twitter ID), a popular cryptocurrency trader

Photo by Harley-Davidson on Unsplash