The greatest outlet for this business in Los Angeles might end up being. . . canned water – Heaven32

Earlier this week, Science Inc, the 10-year-old Los Angeles-based incubator and venture capitalist, launched a blank check company at Nasdaq, raising $ 270 million for which company founders Peter Pham and Mike Jones say she’ll be used to marketing a business in mobile, entertainment, or direct-to-consumer services, or perhaps a business that combines all three.

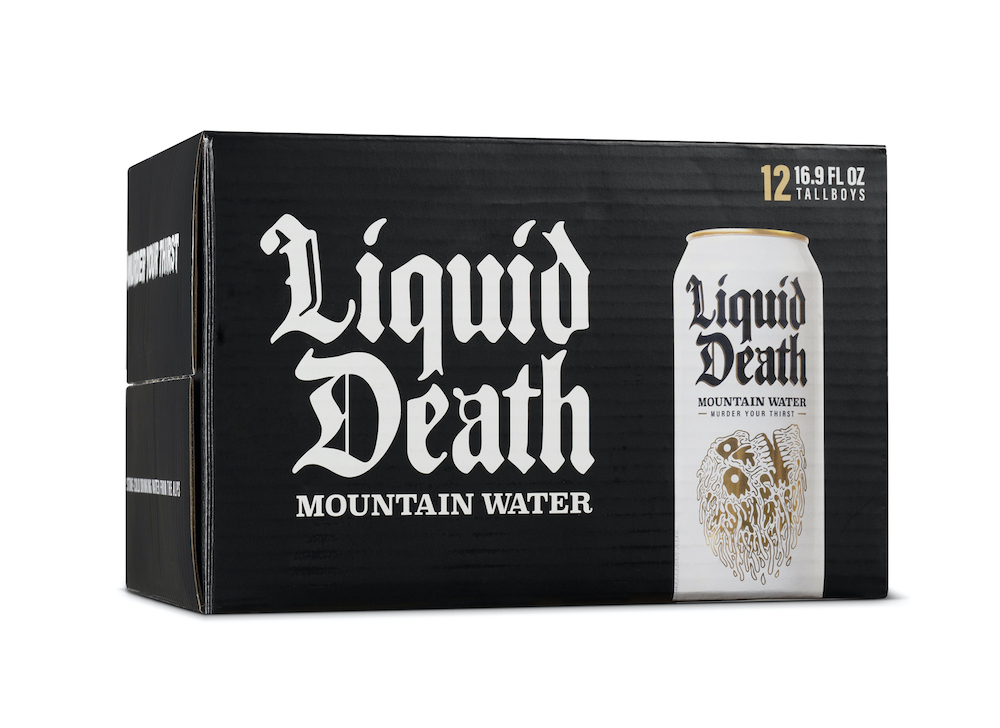

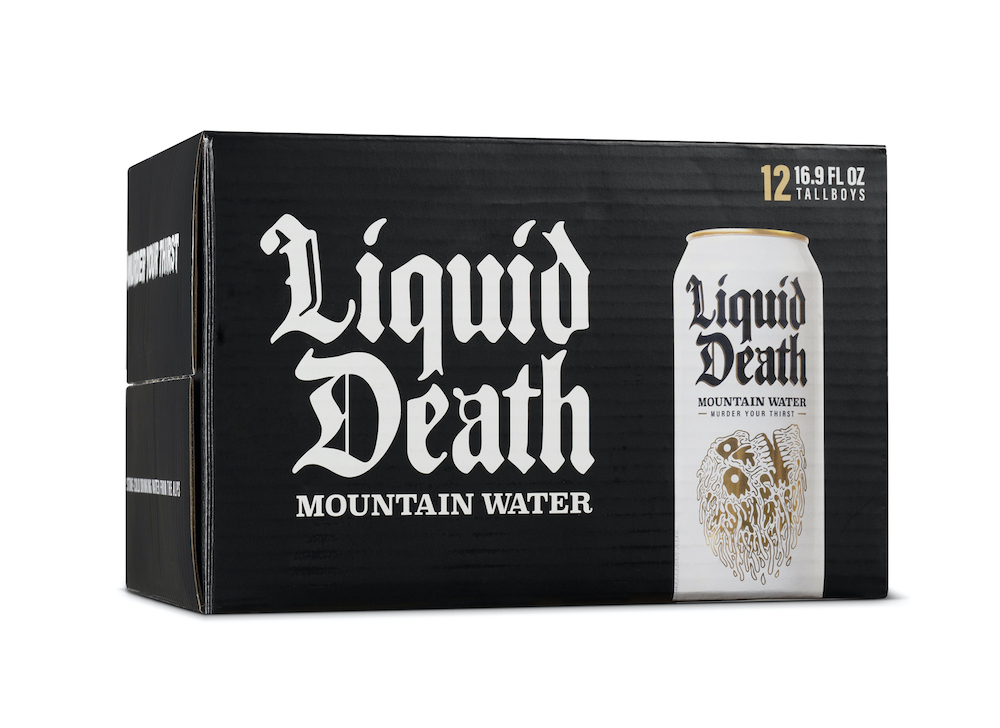

If they have one of their own holding companies in mind to go public, they won’t say so in yesterday’s conversation. Science would have some interesting candidates to choose from. He was instrumental in the blossoming of the amateur sports platform PlayVS after Pham met its founder, Delane Parnell, on a dance floor at a South by Southwest festival. He is also an investor in Bird, the micro-mobility company that would work with Credit Suisse to strike a deal with a blank check company. And he helped start and grow Liquid Death, a company with a tongue-in-cheek marketing strategy that sells mountain water in aluminum cans. A lot, Pham says.

In fact, we spend a lot of our time with the duo discussing how to build a strong mainstream brand in 2021, when so many people vie for attention on the same saturated platforms. Much of this talk follows, edited slightly for length and clarity.

TC: You have this new blank check company. You are about to start talking to potential targets. Would you consider a business that you have incubated or funded in the science field?

MJ: No. So PSPC is an independent entity. We believe there is a universe of over 100 companies that would match the benchmarks of what we’re looking for in the stack. Some of these companies we may or may not have investment exposure [to them], but the analysis process is independent of the scientific portfolio.

TC: So you wouldn’t rule it out.

MJ: We have independent directors. So there is a different process that I would go through if we were looking at a company in the portfolio. But for now, we’re just adding the correct universe of potential targets. And then we’ll go through a formal process on this.

TC: What are the metrics you want to see? You are specialists, even in direct consumer companies. Do the businesses you target have to be profitable?

MJ: When we look at the different potential businesses that we’re interested in, we’re not saying they have to have a specific level of profitability or level of income. . . We are not discussing the basic metrics and revenue drivers that we believe contribute to the success of businesses within industries. But we’re a super data-driven team. We’re at the forefront of next-gen Gen Z and Millennial Marketing. And there are some very specific things that we are looking for that we believe can create remarkable brands.

TC: You both know the social media space. There are new social media plays that are getting a lot of attention, like Clubhouse. Going back to your main activity in science, are there any investments in these areas in this area that you are considering?

PP: Ten years ago, YouTube became a marketing platform. Then six or seven years ago, Instagram [became a platform for marketing]. And then Snapchat came along, then all of a sudden the Instagram stories [emerged], then TikTok and now another platform, which is Clubhouse. There is always something new around the corner.

You can’t take your eyes off Facebook, Instagram, and Snapchat, but Clubhouse is real. It’s almost radio, but it’s participatory. If you go south by southwest, it’s almost like SWSX signs all day. There’s a really interesting dynamic where you can be in the crowd, raise your hand, and if they take you on stage, you’re now part of the panel. That’s why there are a lot of people, to have the opportunity to be discovered. [and] the opportunity to have your voice heard by a wider audience.

TC: What makes you think its growth is sustainable?

PP – The moment when marketers join a platform [you know]. When it’s real estate traders, people selling lessons on how to make money, how to own real estate, how to make money. [selling] real estate, that kind of marketing, when [they show up], is an arbitration. They are basically very smart people who make a lot of money realizing that every minute they spend doing this is more valuable in terms of ROI, cost of customer acquisition and revenue, than spending money. time on this something else that everyone else is.

TC: How are the companies in your portfolio using these platforms in 2021? You invest in Liquid Death. You helped hatch MeUndies, a subscription-based underwear company that raised $ 40 million at the end of last year. You were involved in the early days of the Dollar Shave Club. How do you break through noise with things like water, underwear, and razors?

PP: Platforms are always a springboard. We cannot trust these places in the long term because the rules of the game change, the regime changes. Ten years ago when we launched Dollar Shave Club, we had this YouTube video auto-playing on our homepage, it was just about pushing customers to buy something. At the time, no one had thought of posting YouTube videos to get someone to buy something. MeUndies [did really] good on Instagram. Who would imagine subscription underwear? But every month there is a holiday: Christmas, New Year, Valentine’s Day, Saint Patrick’s Day. What if there was something cool and fun you could use?

With Liquid Death, it’s still a lot [focused on] Instagram and now probably TikTok. But in any case, the mark has to be worthy so that someone can talk about their interest.

Mike underestimates our data side, but we continually measure everything that is going on in each of our businesses, including their social reach, their engagements, company retention, how often customers come back, how much of the income we generate from everyone. individual, how much marketing is worth. All these elements are linked to this complex engine which [helps us determine], Is there a company behind this? Can it develop on its own without relying on Facebook? With most businesses, if you don’t understand how to build your own community, your own brand, and your own audience, the ultimate winner is Google or Facebook.

TC: How do you build this community?

I personally delivered 4,000 cans. At the start of Liquid Death, I only remember giving it to a bunch of teenagers, and six out of 10 were taking a picture and taking it of their friend. It was then that I kept watching over and over again, and I knew it would work. If you noticed in March, April, and May how boring your Instagram feed was because everyone was staying at home and there was nothing to do. But we [had this insight to] Give someone some content.

TC: Liquid Death is now available in select stores, including 7-Elevens. Are people buying water online? What percentage are you buying by subscription?

PP: a third of our customers who buy online [at the site] buy goods. They buy caps for $ 24, hoodies for $ 45; we are constantly selling products. It’s the brand, it’s a lifestyle. Mike Cessario, the CEO, says he’s building something that looks like his favorite band. The product lets you be a fan of the thing. [including] because it’s not a piece of plastic that goes to the ocean [like other water bottles]. It’s not sugar. It is not alcohol that could lead to an impaired driving incident.

The trajectory we are on is difficult to measure; you have to see it, and when you see it over and over again, it’s obvious.