Bitcoin has officially seen its third mining awards event halved. Scheduled to occur every four years, this event reduces block rewards by 50% to make the asset deflationary.

The short-term optimism of this event is widely debated.

Some analysts believe that the drop in profitability seen among miners will cause them to stop selling their newly created BTC until the price of the cryptocurrency rises again.

This would alleviate a significant amount of sales pressure that crypto is constantly facing.

The fundamental data shows that BTC is now leaving the event in an excellent position, and this data convincingly pleads for crypto to see immense optimism in the weeks, months and even years to come.

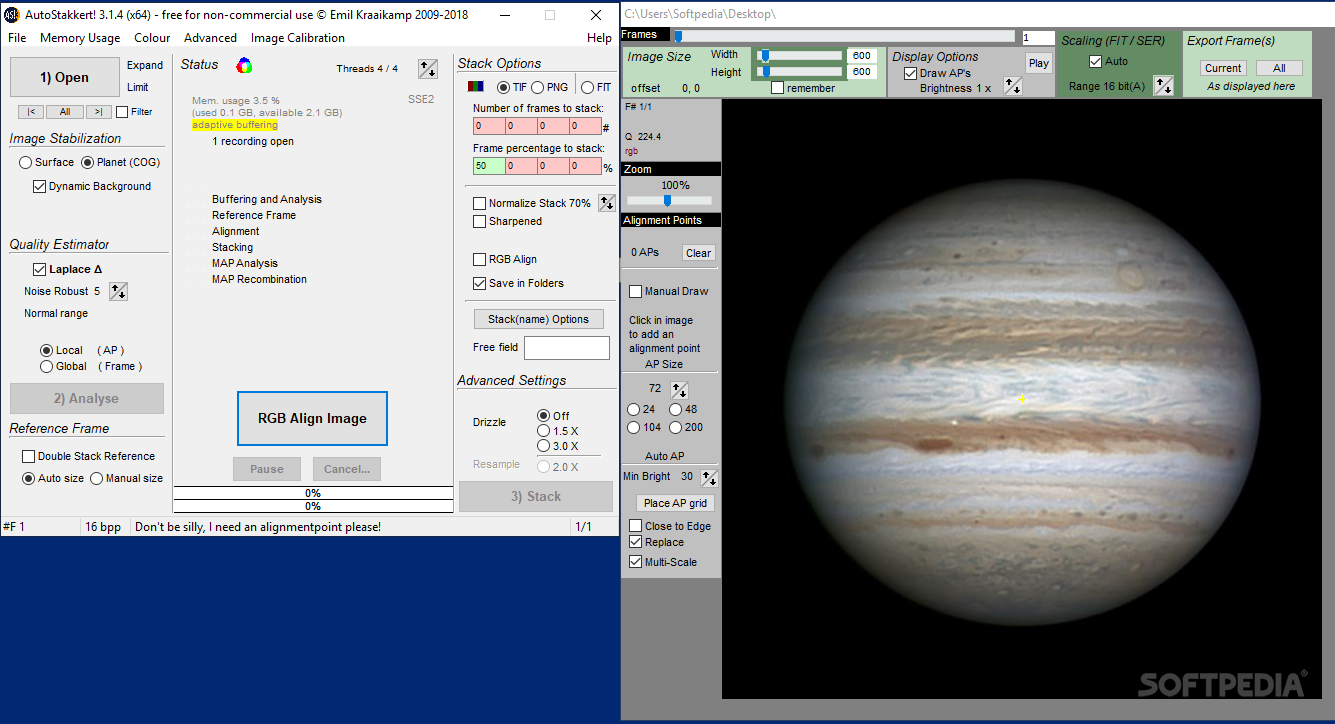

Bitcoin has seen huge network growth over time since the last semester

Four years have passed since the last event to halve the benchmark cryptocurrency, and the growth it has experienced over the ensuing time has been quite significant.

This is clearly clarified by looking towards the growth of the Bitcoin network, which recently took an important step when the address of the 30 millionth wallet was published.

Rafael Schultze-Kraft, co-founder of the Blockchain Glassnode research platform, spoke about the fundamental strength of crypto in a recent tweet thread

, explaining that the number of BTC wallet addresses has increased by 234% since the 2016 mining awards have halved.

"The number of Bitcoin addresses is constantly increasing and currently at ATH. It recently crossed the 30 million addresses mark. This is an increase of + 234% since the last halving four years ago, "he noted, referring to data from Glassnode.

Image courtesy of Glassnode

Additionally, he goes on to explain that the rate of increase in the number of wallet addresses has been staggering, with the daily number of newly issued addresses increasing by 68% in the past four years.

“Not only is the network increasing, but so is the rate of growth. The current growth rate (daily number of addresses added to the Bitcoin network) is 68% higher than that of the last half four years ago. "

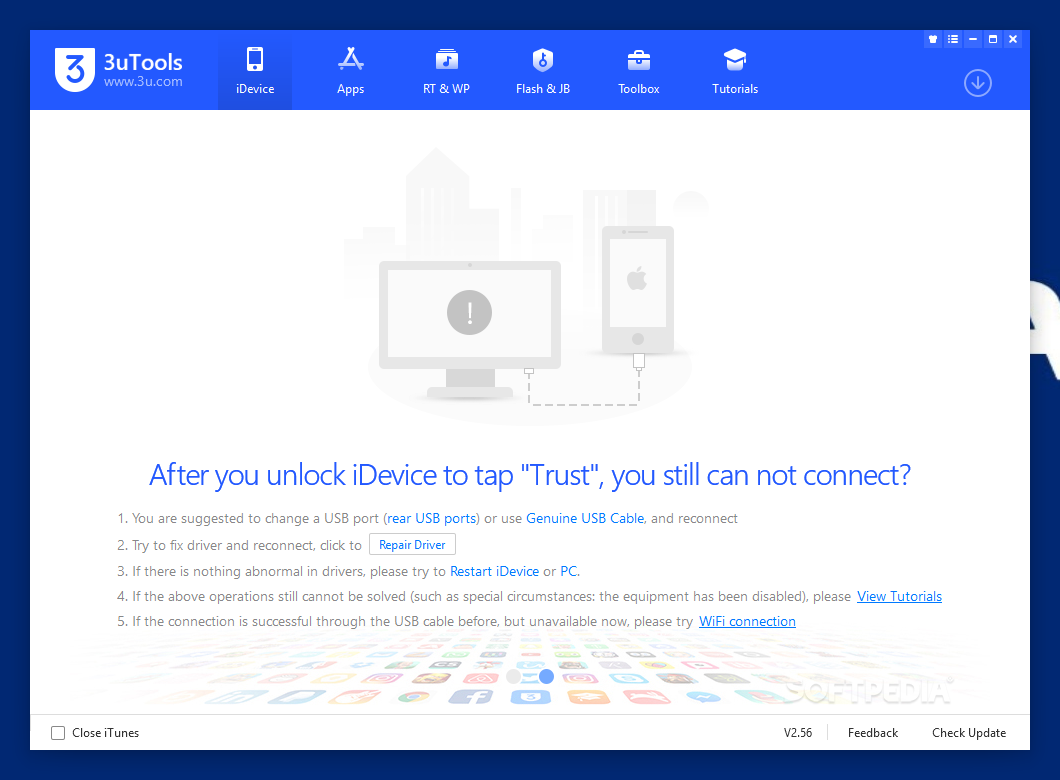

Whales accumulate as long-term prospects become bright

Retail investors aren't the only ones who have flocked to Bitcoin recently.

Glassnode data also shows that the number of so-called "whales" has also increased significantly in recent times.

This is a sign that a lot of money is being invested in BTC as its medium and long term prospects improve.

"The number of Bitcoin addresses and entities with ≥ 1,000 BTC are poised to reach new HUDs in 2020. Although the increase since the last semester is not significant, it's important to note that the USD value they have is over 10 times higher, "said Schultze-Kraft.

Image courtesy of Glassnode

As small and large investors flock to Bitcoin, it is increasingly likely that the cryptocurrency will soon begin to bear fruit from the immense fundamental growth seen in recent years.

Featured image from Unplash.