Some of the major alternative currencies by market capitalization, such as Ethereum, have recently posted significant gains. Meanwhile, Bitcoin remains stagnant in a narrow trading range.

The flagship cryptocurrency has consolidated between $ 8,800 and $ 10,080 since the end of April without giving clear signs of its next destination.

One of the top industry analysts argues that Bitcoin’s inability to exceed the $ 10,000 resistance level adds credibility to a sudden bearish momentum that could plunge it to $ 6,300.

However, others believe that the pioneering cryptocurrency shows a pattern of technical manual, called the descending wedge, which can reach $ 11,500.

Whatever the ambiguous perspective, various measures by the chain suggest that a significant price movement is underway.

Bitcoin is ready for wild price action

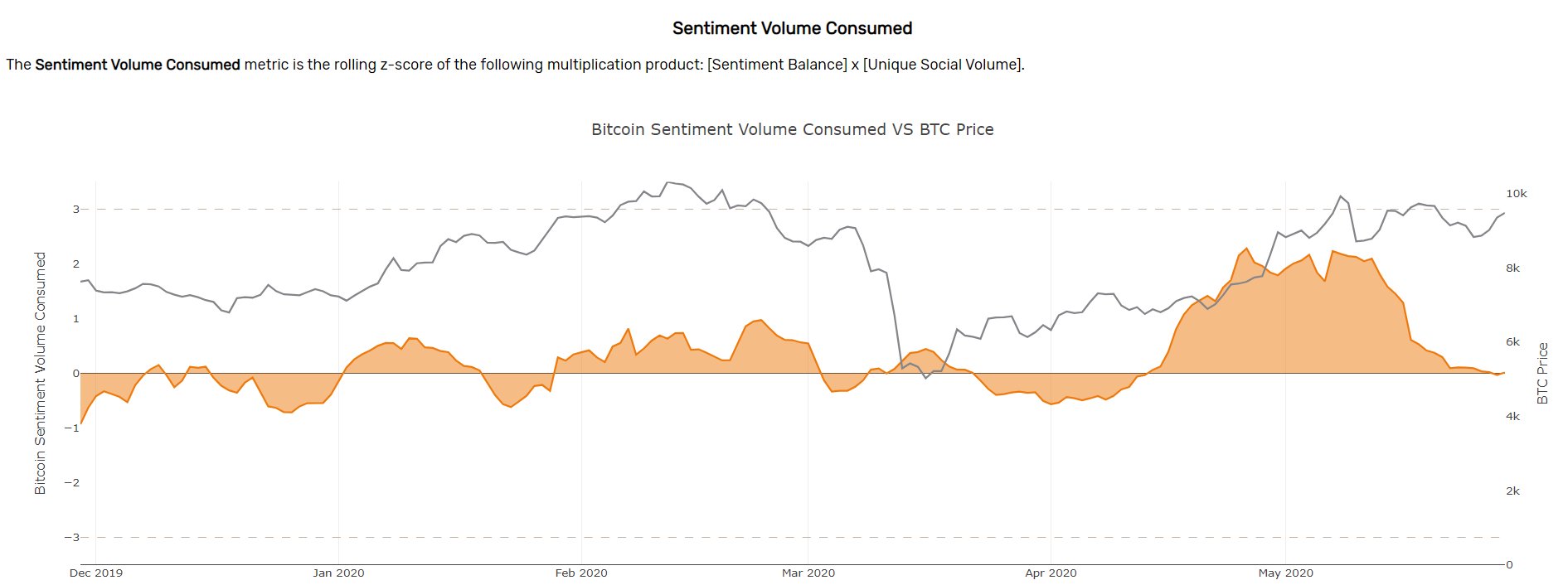

Santiment, a behavioral analysis platform, popular in a tweet that Bitcoin could benefit more from the next big capital inflow. The firm claims that its “Twitter Sentiment Volume Consumption” index shows that the BTC is floating in neutral territory, which can be interpreted as a positive sign.

“Historically, prices rise more noticeably when the crowd becomes negative, and vice versa when the crowd becomes positive,” said Santiment.

Bitcoin’s Twitter sentiment volume has consumed. (Source: Santiment)

In fact, dull Bitcoin is triggering a new wave of bearish views around it. For example, Whale Alert recently reported the movement of 3,000 BTC, equivalent to over $ 28 million, transferred from an unknown wallet to the Hong Kong-based cryptocurrency exchange Bitfinex.

🚨 🚨 3,000 #BTC ($ 28,414,167) transferred from an unknown wallet to # Bitfinex

– Whale alert (@whale_alert) May 29, 2020

Many market participants viewed the transaction as a very negative sign, and some commented: “¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡¡!!! ¡¡¡¡¡¡ ¡¡¡¡¡¡¡!!!

From a negative sentiment perspective, the pessimistic views expressed regarding the transaction reported by Whale Alert may be a bullish sign, asserted Believing Since the wisdom of the crowd is generally inaccurate, betting against it can be a profitable strategy.

Strong support, low resistance

InoTheBlock’s (In / Out of the Money Around Price) model (IOMAP) also shows that from a chain viewpoint, Bitcoin can go higher.

IOMAP cohorts show that the main cryptocurrency is at the top of a significant supply barrier between $ 9,270 and $ 9,560 which can prevent a sudden decline. Here, around 1.6 million addresses have purchased nearly 1.2 million BTCs.

Entry / exit of money around the price. (Source: IntoTheBlock)

If this supply wall can be maintained, the bulls should push Bitcoin above air resistance for the uptrend to resume. Breaking above the $ 9,580 – $ 9,850 level where 869,000 addresses bought 606,000 BTC, leaves Bitcoin open for a recovery to the next significant resistance level around $ 11,500.

With such a bright future, it is crucial to implement a healthy risk management strategy when Bitcoin is trading to avoid ending up on the wrong side of the trend.