"Selling American": Buffett gives up most of its stake in Goldman, JPMorgan cuts in the turbulent first quarter

[ad_1]

Airlines are not the only sector that Warren Buffett left in particular in April, before the annual meeting of Berkshire Hathaway.

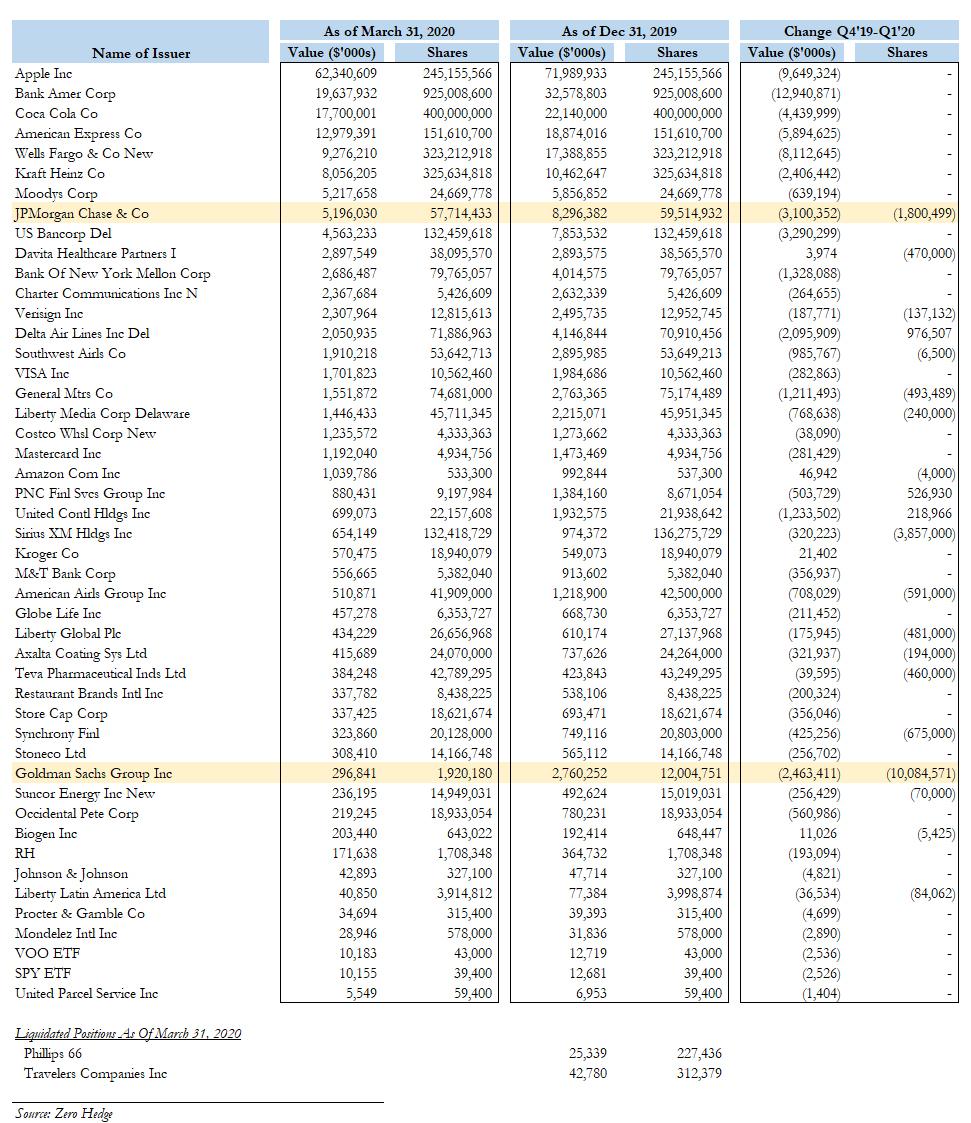

According to the recently presented report Berkshire 13F, in the first quarter, when the conglomerate's equity holdings reached a record $ 66.5 billion, the value of the equity positions revealed by Berkshire fell from $ 242 billion on December 31 to $ 175.5 billion the 31st of December. In March Buffett also sold the majority, or 84%, of its stake in Goldman Sachs, previously one of Berkshire's top 20 positions, selling 10 million shares of which as of December 31 was a position of 12 million, while reducing its stake in JPMorgan by 3% (from 59.5MM to 57.7MM).

The sale of Goldman by Buffett, which at one point fell 33% in the first quarter, was not characteristic of an investor who was not only a major investor in the banks in the past (selling, where appropriate, to keep bets below the 10% "active investor" threshold analyzed by regulators), but also represents a makeover for a company that Berkshire bailed out during the financial crisis with an expensive investment of $ 5 billion in the form of perpetual preferred stock, generating a dividend of 10%.

This time, however, instead of "buying American," like Famous buffett said In his opinion article on the NYT of October 16, 2008, Buffett sells quietly.

In addition to reducing its position in Goldman and JPMorgan, Buffett also liquidated its holdings in Travelers and Phillips 66, a small portion of an interest that had been valued at more than $ 25 million at the end of the year. ;year.

Separately, Buffett also reduced its positions at Davita (1%), Verisign (1%), Amazon (0.7%), GM (0.7%) and various other companies, as shown in the table below. The only position increases in the quarter were recorded at Delta Airlines, where it added 1.3% to 71.9 million shares just to get rid of them a few weeks later, and PNC Financial , just one week before the bank decides to liquidate the whole. 20% Blackrock.

As a reminder, on May 3, Buffett announced that Berkshire had completely abandoned its participation in the top 4 American airlines, and admitted that it had made a mistake.

![Download American Football Logo [AEP] Free Download Download American Football Logo [AEP] Free Download](https://getintopc.com/wp-content/uploads/2024/01/VideoHive-American-Football-Logo-AEP-Free-Download-GetintoPC.com_.jpg)