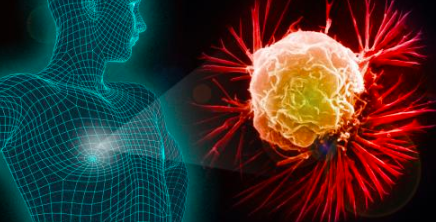

Are you considering buying a cancer insurance plan? Know what are the inclusions and exclusions of this policy

[ad_1]

The major change in our lifestyle and stress has made us vulnerable to many critical ailments, even at a young age. Cancer has gradually become an epidemic. The cost of cancer treatment is very expensive and can put a financial burden on your family. Given this difficult fact, buy a cancer insurance The plan has become the need of the hour. A cancer insurance plan is a type of insurance policy that offers financial assistance to cover expenses incurred to treat this disease. This insurance policy covers costs associated with the diagnosis, hospitalization and treatment of chemotherapy and radiotherapy.

Today, many big brands like Religare Health Insurance, HDFC Ergo and ICICI Lombard offer health insurance policies with cancer cover. Let's see what are the common inclusions and exclusions of health insurance policies so you can choose the best one.

Cancer insurance plan inclusions

The inclusions mean the coverage and benefits you get under your health insurance policy. To better understand a cancer insurance plan, let's look at its inclusions:

- Chemotherapy and radiotherapy coverage: Cancer is one of those diseases that requires regular care. Cancer insurance covers chemotherapy and radiation therapy up to the sum insured through reimbursement or cashless service.

- Types of cancer covered: Some of the common types of cancer covered by insurance policies are breast cancer, lung cancer and stomach cancer. In most cases, money is paid at different stages of diagnosis, treatment and surgery.

- Advantage of premium waiver: Some cancer insurance policies offer the option of waiving premiums. If the claim is approved under the main stage indemnity clause, all current future policy premiums will not apply for the remainder of the term of the contract.

- Hospital costs: You will benefit from hospitalization cover for cancer treatment as part of your cancer insurance. It can be hospitalization, pre- and post-hospitalization, hospitalization at home or even nursery care. The insurer will pay your medical costs as cashless treatment or reimbursement up to the amount insured.

Exclusions from the cancer insurance plan

It is important to note that a cancer insurance plan also includes certain exclusions. These are illnesses or conditions that are not covered by your insurance company. The exclusions differ from one policy to another.

- Most cancer insurance plans do not cover skin cancer.

- Any type of cancer that can result from a congenital disease.

- Any cancer that may result from a preexisting condition.

- Any form of cancer that may be caused by nuclear, biological or Chemical contamination.

- Any treatment that occurs or goes back to pregnancy, miscarriage and motherhood, but not to ectopic pregnancy.

- Treatment taken for any medical condition not covered by the benefit that occurs during hospitalization.

- Non-allopathic treatment or linked to the unrecognized medication system.

For takeout

It is always said that prevention is better than cure. Therefore, the other best prevention option is to stay prepared.

Today, there are reliable insurance companies like Religare Health Insurance, HDFC Life and many others that offer specific cancer insurance plans that include coverage for the treatment of this dangerous disease. The insurance plan covers OPD costs, surety bonds and hospital costs.

A cancer diagnosis can also affect your mental health and your savings. Getting a cancer insurance plan acts as a financial cushion that saves you and your family in such situations. It is very important to check whether the insurance company covers treatment costs after diagnosis and whether the benefits are different at different stages of the cancer. Cancer insurance coverage includes medical expenses in addition to hospitalization. By opting for this insurance policy, you can protect yourself from the high processing costs.