Download Create thank-you statements to people who donated to your charity or other non-profit organization using donor information from QuickBooks Free

Download Free Create thank-you statements to people who donated to your charity or other non-profit organization using donor information from QuickBooks

If you own a charity or other non-profit organization and are looking for software solutions to make it as professional as possible, you can use Nonprofit Donor Statement Seamlessly create and send thank you statements to donors based on information pulled from your QuickBooks account.

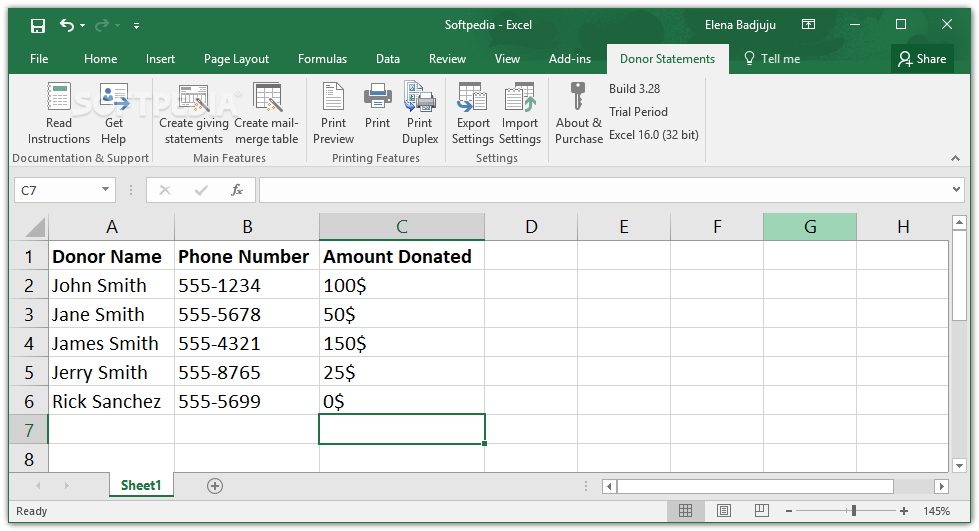

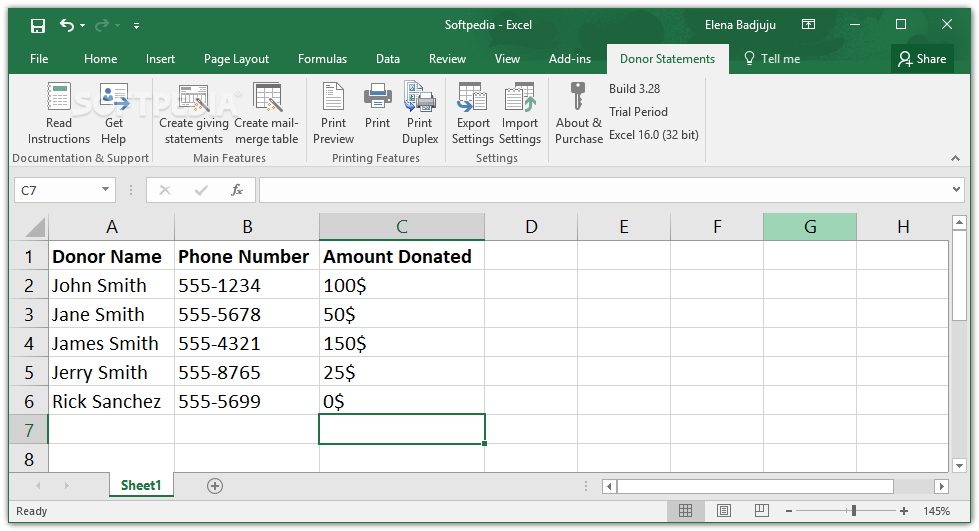

It is a tool integrated as an Excel add-in. During the installation process, you can select the installed version of Microsoft Excel, ranging from 2016/365 to 2000.

Use QuickBooks data to create thank you statements for donors

Once installed, you can open an Excel spreadsheet and access the new add-in from Donor Statements (a new tab created next to Add-ins). In addition to import and export options, it also has options for creating donation reports and mail merge forms.

First, you can get data from your QuickBooks account and set up filters to extract only details within a specific date range. You can also include general journal transactions and unpaid invoices for tracking commitments, with the goal of reminding donors of their remaining commitments to your charity.

Get QuickBooks data on invoices, payments, and more

Information about invoices, payments, sales receipts, deposits, statement charges, and credit memos is automatically pulled from QuickBooks. Also, if you wish, the Nonprofit Donor Statement can capture optional data fields such as shipping address fields (such as street, city, and state), shipping address block fields, and values in custom name fields.

Second, after extracting your QuickBooks data, you can select accounts and projects for tax-deductible donations, donors to create reports for, table styles and options, and logos and signatures. Windows envelope addresses can be neatly aligned in documents.

Write thank you note, choose logo and signature

Additionally, you can edit the layout to adjust and align text, customize fonts, and apply filters for donation amounts, event dates, and more. You can review all options before creating and sending the report.

All things considered, Nonprofit Donor Statement includes rich and intuitive options to help charitable organizations create a statement of appreciation for their donors. It worked smoothly throughout our evaluation.

Download: Create thank-you statements to people who donated to your charity or other non-profit organization using donor information from QuickBooks Latest Version 2024 Free

Technical Specifications

Title: Create thank-you statements to people who donated to your charity or other non-profit organization using donor information from QuickBooks

Requirements: Windows 11 / 10 / 8 / 7 PC.

Language: