Download ePay – Instant Personal Loan 1.6

Download Free ePay – Instant Personal Loan 1.6

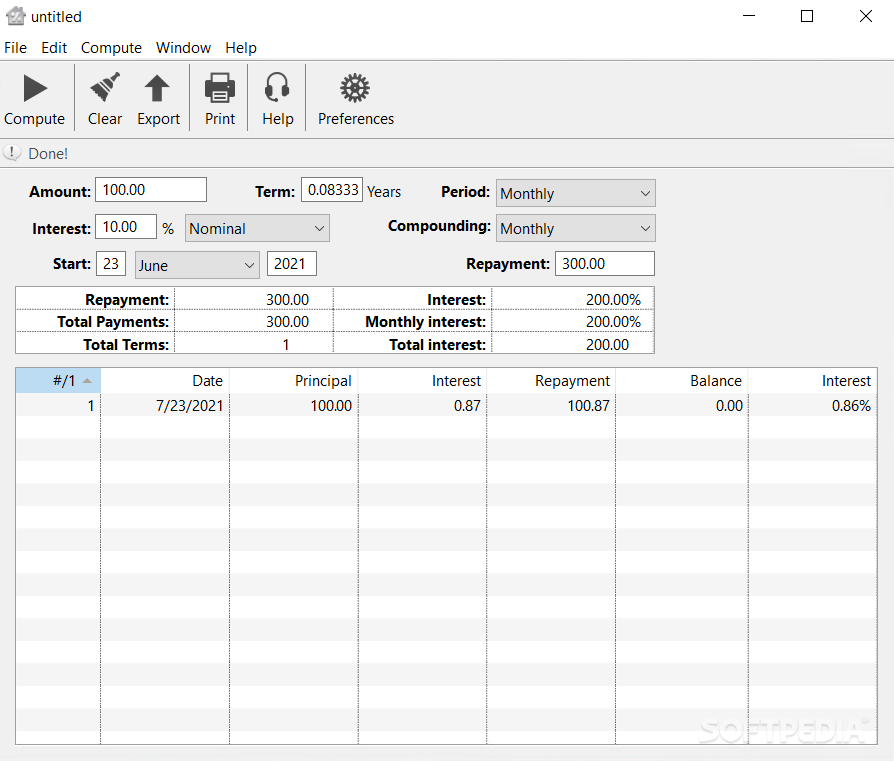

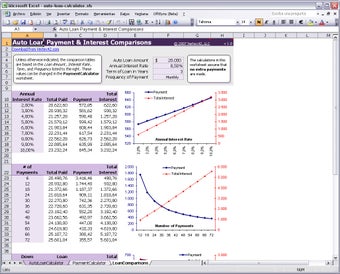

The minimum annual percentage rate (APR) is 12%, while the maximum APR is 28%. In addition, full refunds within 61 days or less are not permitted.

- Total Loan Amount: INR 1,000 – INR 10,000

- Minimum period for repayment: 61 days

- Maximum repayment period: 365 days

- Interest: 12% per year (1% per month)

- Other fees: One-time processing fee

- Approximate APR with interest plus fees: 35.9%

For example, if your loan amount is ₹ 10,000 and the repayment period is 62 days with two equal installments of 31 days each, with an interest rate of 12% per annum and a one-time processing fee of ₹ 1,200, the total cost of the loan would be 1404 NOK The total amount payable will be ₹ 11,404 with a monthly payment of ₹ 5,702.

The ePay – Instant Personal Loan app provides an online platform to apply for and secure personal loans efficiently. Be it a dream vacation, home renovation, wedding plans or a medical emergency, the app offers the convenience of connecting with the best lending partners in India to cater to various financial needs.

Applicants must be at least 21 years old to apply for a loan. The maximum age limit can vary between 60 years for white-collar workers and 65 years for the self-employed at the time of loan maturity. However, specific age criteria may vary between banks.

How to apply for an ePay – Instant personal loan:

- Complete the online application form with personal, employment and financial details.

- Select the desired loan amount and repayment period to receive instant approval.

- An ePay – Instant Personal Loan representative will contact you.

- Receive loan disbursement within 24 hours of approval.

Loan information:

- Borrow up to Rs. 5 lakhs

- Reasonable interest rates from 6.99% pa

- Additional charge:

- Processing fee: 2% + GST

- Convenience Charges: Rs. 4999

- Flexible repayment period from 12 to 60 months

- Full refunds within 30 days are not permitted

Features of ePay – Instant Personal Loan:

- Access to over 50 banks and NBFCs

- Fast approval process

- Serving over 1,50,000 satisfied customers

- Exclusive offers and competitive prices

- No collateral required

- Easy tracking process

Disclaimer:

- ePay – Instant Personal Loan application works exclusively as a digital platform for loan processing to streamline procedures without unnecessary paperwork that banks perform during further loan related processes.

- The loan approval status is determined by the respective bank while we facilitate the digital platform for loan processing.

.

It