Google Removes 100,000 Negative Robinhood App Reviews From Angry Users

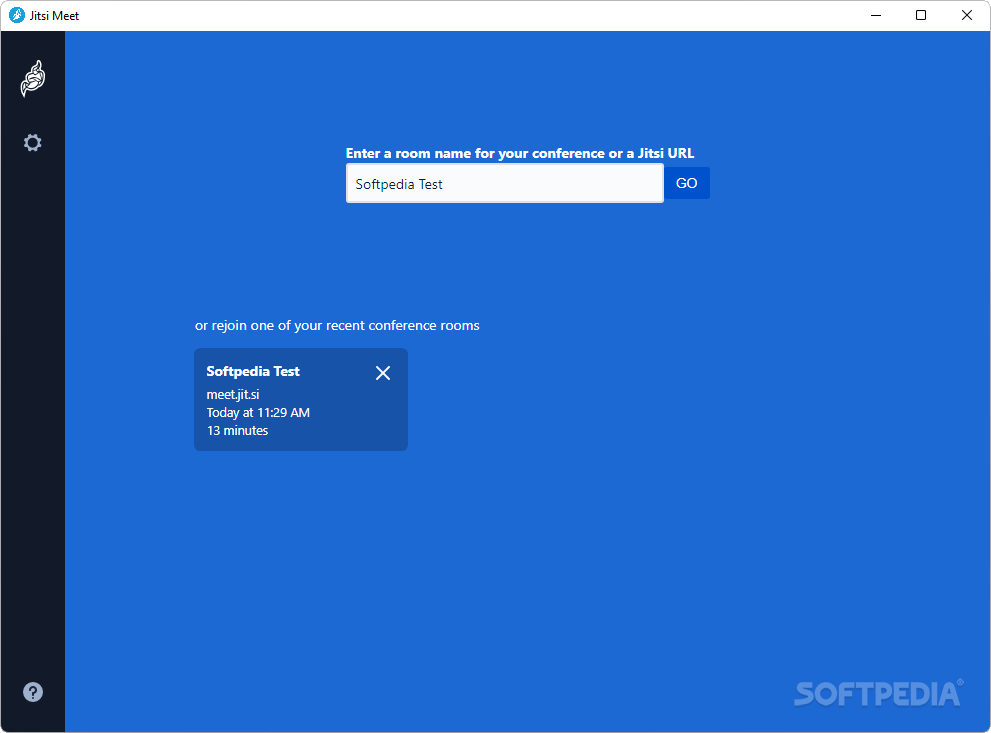

Google removed at least 100,000 negative reviews of the Robinhood stock trading app from the Google Play app store after angry users submitted a flood of critical reviews that brought down the app’s rating on Thursday . The app’s rating went from around four out of five stars on Wednesday to a single star on Thursday. Robinhood users were understandably upset after the company halted purchases of GameStop shares and other actions promoted by Reddit’s WallStreetBets community.

A Google spokesperson confirmed that the tech giant removed criticism and defended the measure overnight, telling Gizmodo via email that it had rules against “coordinated or inorganic criticism.” Gizmodo asked how negative reviews could be considered “inorganic” when people seem reasonably upset with Robinhood’s actions in recent days. Google stopped responding to emails from Gizmodo after this request.

Robinhood’s rating on the Google Play App Store has reverted to over four stars since Google removed negative reviews. The app also has a 4.7 rating on Apple’s App Store, although it’s unclear what kind of restraint Apple made with its Robinhood reviews this week.

There are still questions about what prompted Robinhood on Thursday to halt the purchase of selected stocks by Reddit’s WallStreetBets, stocks that include not only GameStop, but also Nokia, Blackberry and AMC Theaters, among others. An early theory was that the hedge funds that sold the shares had relied on Robinhood to stop trading, but an alternate theory emerged that Robinhood just didn’t have the cash flow to keep trading so much. share purchases.

This latest theory appears to have been reinforced by a new report early Friday. New York Times stating that Robinhood has raised around $ 1 billion from existing investors like Sequoia Capital and Ribbit Capital. Robinhood CEO Vlad Tenev denied the company had liquidity issues CNBC yesterday, but that doesn’t mean you don’t expect liquidity issues in the very near future.

G / O Media can get a commission

Robinhood users angered by the company’s decision to stop GameStop purchases have filed a class action Thursday, a move that seems to lend credence to the notion that a negative review of an app on Google Play isn’t necessarily “inorganic.”

It’s been a hectic week in the stock market as activist retail investors on Reddit have proven the whole scheme to be a pro-rich scam. But no one knows where that will leave US financial markets in the days and weeks to come.

Most Americans know deep in their hearts that the game is rigged. But this week’s actions by activist investors on Reddit have really clarified the rules for the world. The rich will not tolerate ordinary people making money while they are in pain.

The question is, to what extent are hedge fund managers and other wealthy people willing to do this to defend their class interests. If history is any guide, the answer is “far enough”.