In its latest report on the state of Bitcoin, Delphi Digital explains that Bitcoin will take full advantage of the promise made by central banks around the world to do whatever it takes to keep their economies afloat. Or like the Federal Reserve Bank told me:

"(We) will continue to purchase Treasury and mortgage-backed securities from agencies in the amounts necessary to support the proper functioning of the market and the efficient transmission of monetary policy on terms broader financial and to the economy. "

The independent research store said the amount of tax and monetary relief it had promised to boost global economies was more than $ 10 trillion. Such a massive sum of freshly printed cash would likely trigger global inflation, while Bitcoin's deflationary policy will allow it to thrive.

Bitcoin as a hedge against economic uncertainty

The unprecedented move by governments around the world to ensure that "brrr" money printers sooner or later will have serious consequences for the financial system, said Delphi Digital. This type of monetary policy can lead to the loss of their purchasing power for some of the most powerful currencies, which in the long run can be beneficial for Bitcoin as it has happened before.

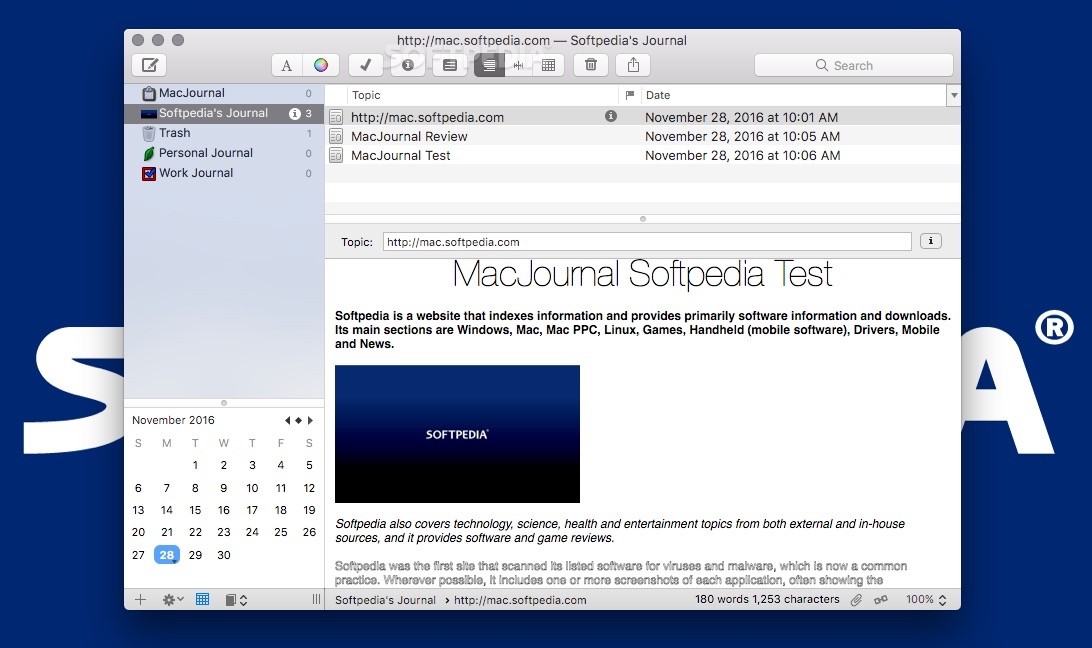

"It should be noted that previous BTC cycles tended to peak when the growth of central bank assets began to slow," said Delphi Digital.

Bitcoin against Assets of major central banks. (Source: Delphi Digital)

While it may take some time before Bitcoin becomes part of the global financial system, it already works well against the currencies of some of the most prosperous nations on the planet.

Against Russian rubble, for example, the pioneering cryptocurrency has grown by more than 44% per year (YTD). Considering the US dollar, Bitcoin shows gains of more than 20% over a year, and against the Brazilian real, it increases by 74%.

Bitcoin vs notable EM currencies. (Source: Delphi Digital)

Bitcoin's impressive performance against some of the "stronger" currencies Delphi expects demand for this non-sovereign "safe haven" asset to increase sharply as the risk of base currency deterioration increases broadly. "

Headlines Exponentially Expose

However, the metrics in the chain show that demand is already on the rise. Delphi explained that the amount of supplies that small wallets have increases over time. This can be seen as a solid sign of "continued growth of new users".

The firm claims that today, more than 14% of Bitcoin's current supply is in addresses within 10 BTC. Meanwhile, the amount of BTC held by the stock exchanges is rapidly decreasing, okay Parts measurements.

"The amount of BTC held by BitMEX and Bitfinex reached new lows after the March 12 accident. Bitfinex now has 93.8K BTC, down from 193.9k on March 13. BitMEX's BTC supply has now dropped to 216.0 K BTC, from a peak of 315.7 K on March 13, "said Coin Metrics.

Although it is not clear how Bitcoin will react to a new economic crisis, some large institutional players believe in the power that this digital asset can have to serve as a cover. Billionaire Paul Tudor Jones, for example, announced that he had invested 2% of his capital in BTC to protect himself from the ravages caused by COVID-19.

Likewise, thousands of Argentines, Chileans, Colombians, Venezuelans and Egyptians are operation

Featured Image from Unsplash