Fear of the fall of Altcoin did not prevent the buildup of Ethereum and Crypto Whales

[ad_1]

After recovering more than 100% of the capitulation lows of March, analysts expect a decline in Ethereum, Bitcoin and other major cryptocurrencies. They cite simple technical factors showing that this market has lost the bullish momentum it had only 10 days ago.

However, these bearish prospects have not prevented investors with large pockets from accumulating.

Deep pockets stack Ethereum and ERC-20 tokens

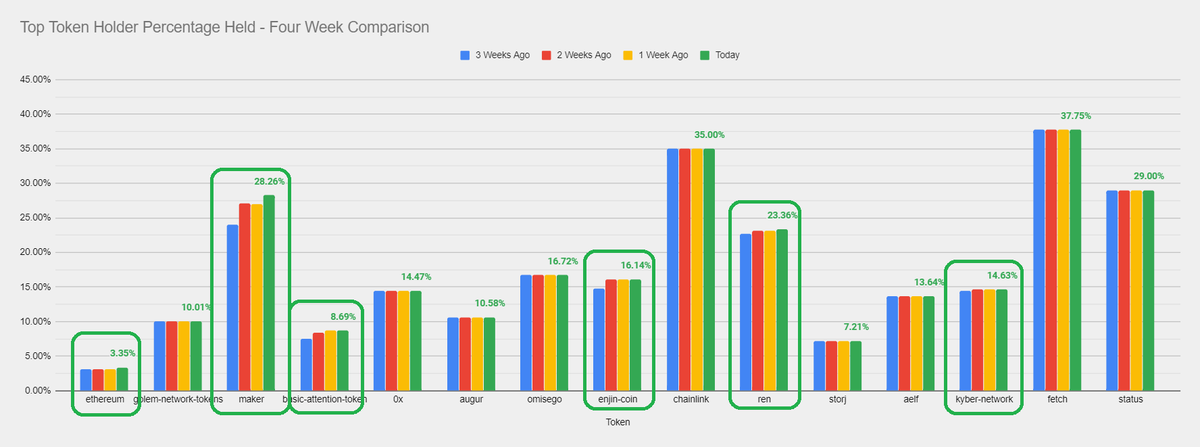

According to data shared by blockchain analytics company Santiment, The main holders of a cryptocurrency band: Ethereum, Maker, Basic Attention Token, Enjin, Ren and Kyber Network, have accumulated their respective coins over the past month.

What has the respective # 1 security holder done with their holdings of various key crypto assets in the past few weeks? Short answer: ACCUMULATION, ”wrote the company, referring to the table below.

Data from int blockchain Santiment (@Santimentfeed on Twitter). The graph indicates that Ethereum headlines and ERC-20 headlines are accumulating at a rapid rate.

In a note on the relevant margin, the data suggest

Whales are also increasing their allocations to Bitcoin, making the accumulation problem a cryptographic trend.

Altcoins on the verge of falling, analysts say

Whales may rush to accumulate Ethereum and other leading alternative currencies, but analysts are currently considering a setback for the altcoin asset class as a whole.

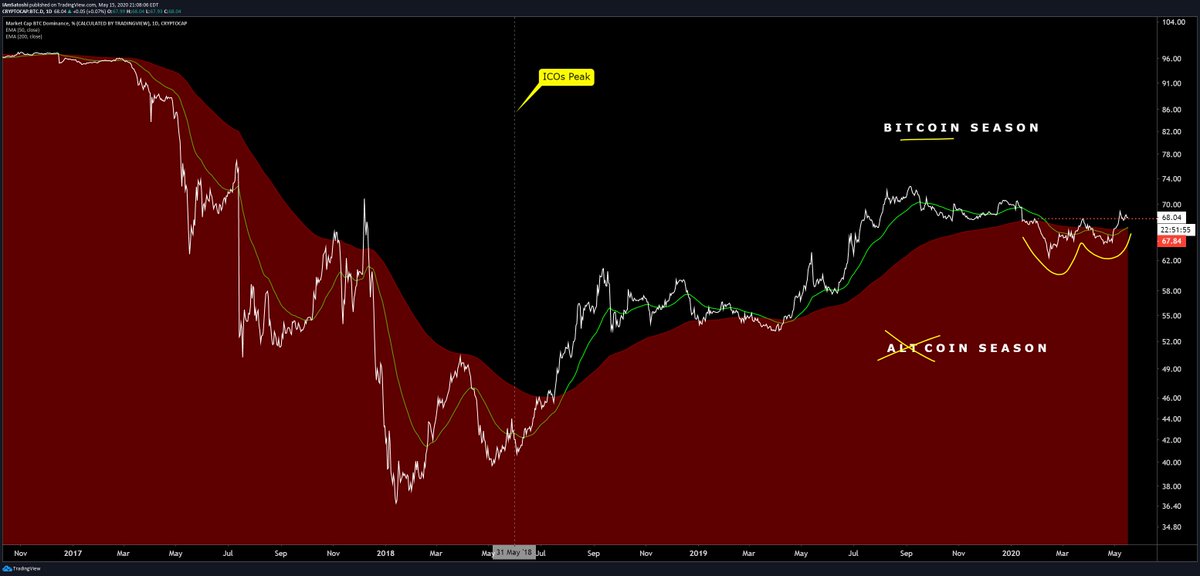

Josh Olszewicz, crypto analyst at Brave New Coin, observed On May 15, the Bitcoin dominance chart printed a sign of strength in a manual: a gold cross.

Graphic by Josh Olszewicz (@CarpeNoctum on Twitter), crypto analyst at Brave New Coin. The graphic comes from the Bitcoin domain printing a formation of "golden cross".

As you can see from the chart above, the previous gold crosses on the Bitcoin domain chart preceded the massive rallies of Bitcoin against altcoins, suggesting that the same thing could happen again.

The senior technical analyst at crypto research firm Blockfyre echoed this prospect. He said the alternative currency market "seems to be able to capitulate soon", adding "that it looks like the worst is yet to come".

Analyst has attributed this sentiment to a number of trends: 1) the Bitcoin dominance chart is expected to increase, 2) halving will centralize crypto wealth in BTC, and 3) many cryptocurrencies still hold millions. worth dollars despite the "red flags" of the underlying technology.

Related reading: Crypto Tidbits: Bitcoin Halved, Reddit using Ethereum, JP Morgan Dabbles in Crypto

Featured Image from Unsplash