There has been a constant drumbeat on the U.S.-China trade front since the start of the Trump administration. President Trump has decoupled the Chinese economy on a proposal over and over again. There was the trade dispute with weekly changes in U.S. pricing policy, threats against ZTE and Huawei, China's responses against Qualcomm and NXP and the launch of new restrictions on Chinese investments in American startups and telecom infrastructure.

With COVID-19 and the global economic collapse that followed, much of this conflict has been put on the back burner. A tentative agreement between the United States and China – agreed before the worst of the pandemic – seemed to gain even wider support as economic indicators from the world's two superpowers began to diffuse.

Then that week happened, and in no time, the trade easing between the United States and China was torn apart.

Overnight, there have been three critical stories that will reshape US-China trade for the foreseeable future, with many more stories hiding beneath the surface.

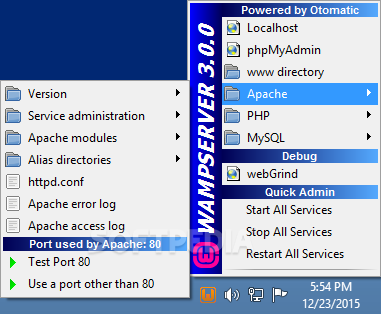

First, you have the announcement this morning from the Ministry of Commerce that the Trump administration is will ban Huawei of the use of American software and hardware in certain strategic semiconductor processes, a measure designed to prevent the main Chinese chip maker from increasing its market power and technological capabilities. Earlier yesterday, the administration also announced a government ban on Huawei and ZTE extended

The Trump administration has threatened such actions since almost the first day of taking office, and Commerce has even spoken, saying it is "tightly and strategically" targeting Chinese society. Nevertheless, the importance of Huawei as one of the leading Chinese tech companies cannot be overstated, and the two movements combined are already seen as a direct attack on China's economic recovery.

Second, you have an important overnight announcement from TSMC

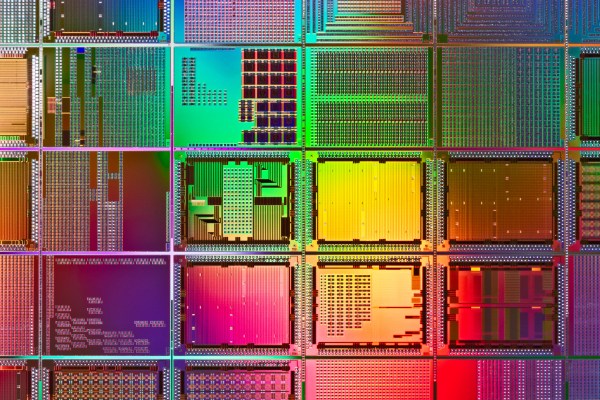

– the largest chip foundry in the world and one of the only foundries capable of manufacturing the most advanced chips – as the Taiwanese company invest and launch a major $ 12 billion factory in Arizona. The release said the plant will be able to produce the world's most advanced 5-nanometer chips when it launches in a few years. The announcement came after weeks of debate in Washington to reduce TSMC's ability to manufacture chips for mainland Chinese companies like Huawei – a move that TSMC said would significantly affect its profitability and ability to invest in new R&D activities.

Third, you announced this morning that Foxconn's profits fell 90% due to COVID-19 and the decline in smartphone shipments. Foxconn, a Taiwanese hardware assembly company (among others), was caught in the stifling trade dispute between the United States and China, and even at one point attempted to build its own $ 10 billion manufacturing plant in Wisconsin

with Trump's felicity only to scuttle this plan entirely in an embarrassing setback.

Meanwhile, the trade deal that had eased tensions between DC and Beijing appears more and more in doubt.

And that’s exactly what happened overnight.

There are so many individual data points on US-China trade that it can be difficult to see trends. Policies have tightened, policies have softened, but in essence, the United States and China have tried to maintain trade, if only to keep their economies growing. That's the coupling: although there may be massive disagreements between the two sides, each has something the other wants. China wants to build and grow, while America wants to design and buy.

The final months of COVID-19 changed this calculation, as did an election year in the United States, where China's distrust hit records, bipartisan highs, polls show. The intense conflagration of the US economy, with tens of millions of unemployed and stalled growth at the moment, means that even more intense scrutiny is being exercised over anything that could hurt the country's financial mathematics. We now see the fruits of this new normal.

There will be more decoupling maneuvers in the coming weeks. There will also most certainly be a renegotiation of the US-China trade agreement, despite comments that none of the parties are interested in reopening these discussions.

However, the real interesting dynamic to watch will be Taiwan, which is home to strategic sectors of the chip industry. TSMC's announcement accepts the reality of decoupling, but attempts to work around this problem by recoupling the United States to Taiwan security. Taiwanese companies and politicians on the island have avoided passing on their technology to other countries, creating an addiction they hoped to protect the island in the event of a Chinese invasion. After all, if the Pentagon can't get its chips, it's going to have to intervene, or the thought holds up.

In this new world, however, the construction of an American factory by TSMC does not undermine this narrative, it actually strengthens the ties between the United States and Taiwan. More jobs, more trade, more travel and, ultimately, a deeper appreciation of the importance of each other. The question is how far the Trump administration is ready to go here. Taiwan is submission to join the World Health Organization, where he was an observer until 2016. How deep are these links? Will the United States go beyond its own diplomatic framework to push intensively for the reintegration of Taiwan despite Chinese opposition?

This is the next step, but what is clear today is that the world of semiconductors, Internet infrastructure, technology links that have united the United States and China for decades – they are frayed and almost disappeared. It's a new era in supply chains and commerce, and an open world for new approaches to these huge existing industries.