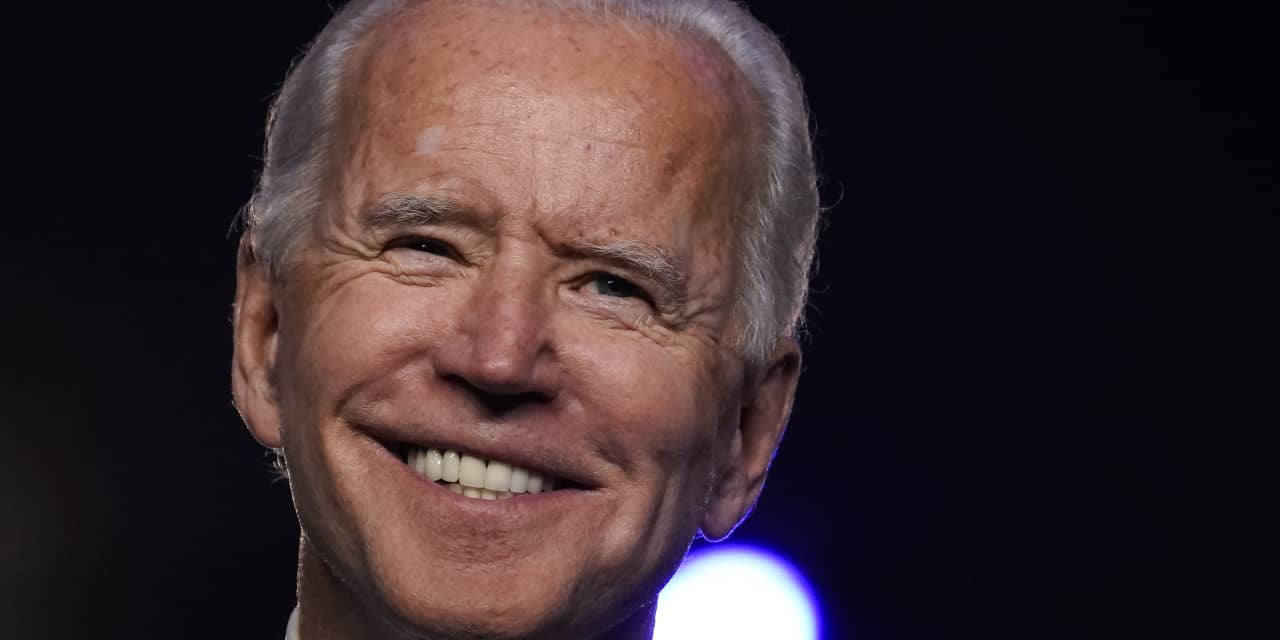

Although the final composition of the Senate is unknown, an administration of Joe biden it can lead to profound changes in public policies. This is what investors and citizens can expect from an administration Biden:

COVID Policy

Polls have shown that the coronavirus outbreak was at the heart of voters’ concerns when they voted for the presidential election, and that they trusted Biden on President Trump to manage the coronavirus.

Biden has pledged in his campaign to increase funding for coronavirus testing, contact tracing and measures to isolate and support people with the virus. The Democratic House passed the Heroes Act earlier this year, the latest version of which allocates $ 75 billion for these initiatives.

He also proposed new funding for schools and child care providers so that they can open safely, while providing funding to parents for child care. The House bill devotes $ 225 billion to these efforts.

Meanwhile, Biden said he would pressure governors, mayors and county leaders to institute warrants requiring citizens to wear masks when in public.

If Republicans retain control of the Senate, funding likely won’t be as strong, but with Biden in the White House, Democrats’ influence will be significantly greater than in 2020.

Stimulus and expenses

Stock markets were up Wednesday and Thursday, with the S&P 500 SPX,

-0.02%

gaining more than 2% every day, despite fears that a protracted electoral process could create political uncertainty that would lead to volatility.

While the odds are high that the Republicans will maintain a tight grip on the US Senate, reducing the chances of a $ 2 trillion stimulus package going to $ 3 trillion, the market is betting there is. will have even more. Stimulus in sight, while lack of Democratic majorities in Congress will reduce the chances of tough new trade regulations.

“Without a blue wave, we will likely see the Senate remain very divided, limiting the political options of who will win the presidency,” Brad McMillan, investment manager for the Commonwealth Financial Network, said in an email. “This likely rules out any substantial tax activity, as well as limiting any action to control big tech companies.”

On the stimulus, Mitch McConnell said on Wednesday that “we need another bailout” and that he hopes it can be done “before the end of the year”. Any plan McConnell endorsed would be lower than a Democratic-led Senate would support, but markets still expect it to be meaningful, McMillan said.

That said, investors must ensure that the return of a Republican Senate and Democratic White House can bring down the debt and spending battles that have characterized the last six years of the Obama administration.

Julian Emanuel, chief equities and derivatives strategist at BTIG, warned investors that this is a dynamic that has contributed to the 3.2% per year underperformance of stocks during divided governments since. 1928. “Expenses and capital gains and other tax increases caused the Nasdaq 100 NDX,

+ 0.11%

to lead a huge market for rising stocks, ”he wrote in a note to clients in recent days.

Healthcare

Biden proposed expanding the Affordable Care Act by increasing subsidies for people who buy insurance on state stock exchanges and creating an alternative government-run insurance plan that any American could choose to purchase. if he is not satisfied with his plans. private.

Biden also proposed allowing Medicare to negotiate drug prices directly, allowing the importation of prescription drugs from overseas and new rules prohibiting surprise medical billing.

Morningstar policy analyst Preston Caldwell believes Democrats will ultimately have to settle for modest changes to the health care system. “I think the degree of Senate leadership is important,” he said, adding that the newly elected Democratic senators come from more moderate states and will be reluctant to sign changes that would destabilize the current system, even if they can win. a small majority there.

Others, like Kim Monk and Rob Smith of Capital Alpha, argued that a public insurance product open to all Americans would have “substantial business advantages over commercial players” that would hurt corporate profits. insurance and, therefore, they would ultimately lead to lower payments to health care providers.

Taxes

Of all the new president’s policy proposals, his promise to raise corporate taxes could have the most direct impact on the stock market.

Goldman Sachs believes that an increase in corporate taxes and an increase in Social Security taxes for high-income earners would reduce income from the S&P 500 SPX Index.

-0.02%

from $ 188 per share to $ 171, resulting in a 9% drop in the value of the index, if the price-earnings ratio remains the same.

But without a Democratic Senate, the chances of a short-term corporate tax increase are effectively nil, and that understanding has also given action a boost.

Climate change and energy

The president-elect has proposed an ambitious $ 2 trillion plan to tackle climate change, promising to invest in incentives for utilities to switch to carbon-free energy sources, for automakers to build more of electric vehicles and upgrade millions of dollars. buildings to make them. more energy efficient.

Biden’s goal is for the power generation industry to produce net zero emissions by 2035 and for the entire U.S. economy to produce net zero emissions by 2050, according to the Nations estimates. United on what will be expected. you must avoid the worst effects of climate change. .

Biden also said he would push to reduce subsidies in the tax code for fossil fuel companies and ban fracking on federal, but not private, land.

The immediate impact these policies could have on the oil and gas industry is uncertain, according to Morningstar’s Caldwell, who said that even aggressive push for renewables still leaves strong demand for fossil fuels in the years to come. .

Meanwhile, a Republican Senate would likely block any legislative changes to Democrats’ climate policy (Republican lawmakers have their own versions that largely include natural gas in a diverse energy mix), although Biden may have significant leeway to act through EPA regulations.

At the same time, the performance of the energy sector depends more on the dynamics of global supply and demand than on public policies. The Donald Trump administration was very friendly with fossil fuel producers, but the S&P 500 energy sector has still performed poorly over the past four years. Since November 2016, the Energy Select Sector SPDR Fund XLE,

-2.16%

returned a negative return of 14.8% against a positive return of 14% for the S&P 500.

Technological regulation

The need for greater oversight of big tech companies is one of the few issues on which there is bipartisan consensus, although disagreements persist over what form to take.

While Republicans have criticized social media companies for what they claim to be unfair treatment of conservative views, look for a Biden administration that focuses on antitrust regulation and privacy.

Experts say a Biden administration will likely lean on the Trump administration’s antitrust stance on big tech, illustrated by a recent lawsuit against Google GOOGL,

-0.15%.

“People are politics,” Ed Mills, Washington policy analyst at Raymond James, told MarketWatch. “You might see Biden appointing an FTC chairman and a Justice Department antitrust chief take an even more aggressive stance.”

Trade

The president has broad powers to dictate U.S. trade policy, and President Trump used those powers aggressively during his first term to increase tariffs on U.S. importers of Chinese goods and force the Chinese to pledge d ‘buy more American products. .

Joe Biden has previously defended China’s membership in the World Trade Organization, but recently argued that the United States should join its allies in “combating China’s abusive behavior and human rights violations », In an article in Foreign Affairs. at the start of this year. Experts say he will likely maintain Trump’s tariffs on China, but take a more multilateral approach to tackling China in the future, through consultations with its allies.