Download Free Educational Guides on Wallets and Private Keys: Enhance Your Cryptocurrency Security

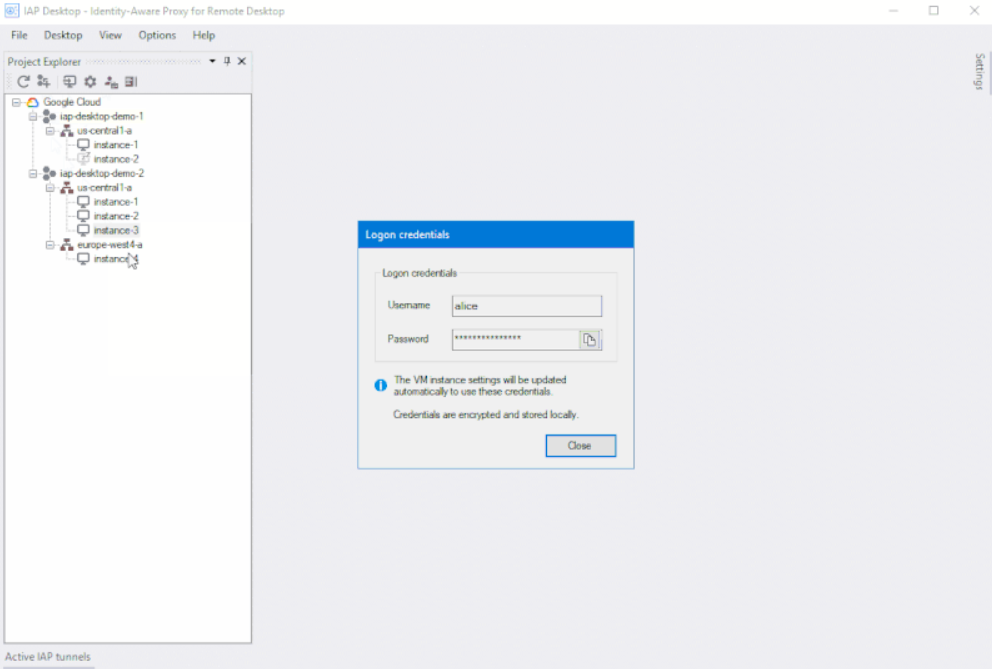

One secure method for storing private keys is by using a hardware wallet such as a Ledger Nano S. These physical devices provide an extra layer of security by keeping the private keys offline and away from potential digital threats.

Understanding the Role of Private Keys

Private keys are like the secret passageway to your digital treasure trove. They’re these long, random numbers that might not look like much, but they’re incredibly important. Essentially, they are the passwords to your cryptostake cryptocurrency funds and transactions.

Imagine you’re the captain of a ship and your private key is the map to buried treasure. Without it, there’s no way to access all the chests of gold and jewels inside. Similarly, without your private key, you can’t access or control your digital assets.

The private key generates a unique signature for every transaction you make within the blockchain network. It’s what proves ownership over specific addresses and authorises the movement of funds from those addresses.

In a way, the private key is a bit like a magic wand in a wizard’s world—holding incredible power as long as it remains safe and protected.

If someone gets their hands on your private key, they essentially get total control over your digital wallet. They can send your funds anywhere they want, and once the transfer is done, it’s irreversible. There’s no “undo” button in the world of blockchain transactions—once it’s gone, it’s gone!

Your private key is what empowers you as a crypto owner—it gives you complete control over your digital assets without relying on any third-party assistance. This means that if something goes wrong, there’s no help line or customer service centre to call up and sort things out for you. You’re on your own with this responsibility.

By understanding the gravity of this responsibility, you’ll see that safeguarding your private key becomes non-negotiable.

In essence, your private key isn’t just another password to remember; it’s the golden ticket to your entire cryptocurrency vault. Protecting it at all costs should be at the top of your list of priorities when dealing with digital assets.

Understanding how vital our private keys are in the world of cryptocurrency reveals why ensuring their security is imperative.

The Functionality of Digital Wallets

So, you’ve got your private key, your exclusive digital signature for making blockchain transactions. But where do you store it? Enter the digital wallet. Digital wallets are like your very own crypto bank; they securely hold and manage your private and public keys, allowing you to send and receive various cryptocurrencies.

There are different kinds of digital wallets, each serving their unique purpose. Software wallets, like Atomic Wallet, are applications installed on your computer or mobile phone. They’re user-friendly and great for daily use due to their accessibility and convenience. Then there are hardware wallets such as Ledger, which provide an added layer of security by storing keys offline and away from potential online threats—akin to keeping your money in a safe deposit box at a bank rather than carrying it around daily.

One more type to note is Web3 wallets like Metamask, enabling interaction with decentralised applications (dApps) on the Ethereum blockchain—particularly handy for engaging with the world of decentralised finance.

Imagine having a wallet hanging around your neck everywhere you go; that’s what Web3 wallets offer, giving you access to different decentralised applications and services while surfing the web.

No matter the type, all digital wallets have one thing in common: ensuring that your private keys are kept secure from prying eyes and potential hackers.

Some people prefer the ease of using software wallets like Metamask due to their seamless integration with various decentralised finance platforms, while others prioritise security and peace of mind by choosing hardware wallets like Ledger or Trezor.

Now that we understand the diverse variety of digital wallets available and how they safeguard our private keys and digital assets, it’s essential to consider factors like user interface, security features, and compatibility when selecting a wallet best suited to our needs.

Varieties of Wallets: From Software to Hardware

When it comes to storing your digital assets, there exist various types of wallets to choose from. Understanding the differences between them empowers you to make an informed decision based on your individual needs.

Let’s start with Software Wallets. These are akin to regular wallets, but for your cryptocurrencies. Available as applications on your computer or smartphone, they offer ease of access, ideal for quick transactions and balance checks due to constant internet connectivity. However, like regular wallets, if someone gains access to your phone or computer, they can take your coins.

On the flip side, we have Hardware Wallets, physical devices resembling thumb drives that keep your private keys offline. They only connect to the internet when making a transaction. Consequently, even if a hacker attempts access while your hardware wallet is securely stowed away, they won’t be able to touch your funds.

Physical devices such as Ledger offer an additional layer of security by safeguarding private keys from hacking and malware threats that typically target software wallets. They’re comparable to a secret safe for your digital money.

Many people appreciate the peace of mind accompanying their private keys being stored on a device untouched by the internet, while others are attracted to the easy accessibility offered by software wallets. It all boils down to personal preferences and security concerns.

For instance, consider carrying around a briefcase containing important documents. It’s preferable if a potential thief encounters a complex puzzle or multiple locks (like with a hardware wallet) rather than having easy access (like with a software wallet).

Web3 Wallets

Web3 wallets are tailored for interacting with decentralised applications and grant users direct access to the decentralised web, serving as gateways to various blockchains. Metamask is a prime example of such a wallet, enabling users to engage with different blockchain networks directly from their browser.

So whether you opt for a software wallet for its convenience or a hardware wallet for its enhanced security, it all boils down to identifying the most suitable fit for your specific cryptocurrency usage and security requirements.

In this age of digital financial empowerment, mastering the art of securing your crypto-assets is indispensable. Let’s now delve into a realm where proactive measures shape the fortification of one’s digital wealth.

Mastering Wallet Security Measures

When it comes to cryptocurrency, keeping your funds secure is just as vital as making smart investment decisions. Wallets act as the gatekeepers to your digital wealth, providing access and management through private keys. Here are some essential security measures that you should consider implementing to protect your hard-earned assets.

Hardware Wallets: The Offline Guardians

Hardware wallets are considered the gold standard for security in the world of cryptocurrency. These physical devices store private keys offline and away from internet-connected devices, providing an extra layer of protection against online threats such as hacking and phishing attempts. When making transactions, the wallet signs the transactions within the device itself, meaning that your private keys never actually leave the hardware wallet.

This way, even if your computer or phone is compromised by malware, your cryptocurrency holdings stored on the hardware wallet remain safe. It’s like storing your valuables in a safe locked inside a vault—double protection.

Two-Factor Authentication: Adding an Extra Lock

In addition to using a hardware wallet, enabling two-factor authentication (2FA) on your online exchange accounts and wallet services is highly recommended. 2FA adds an extra layer of defence by requiring a second form of verification in addition to your password before allowing access to your account. This secondary check could be a temporary code sent to your mobile device or generated by an authenticator app.

By requiring both something you know (your password) and something you have (your phone or an authentication token), 2FA significantly reduces the risk of unauthorised access to your accounts, even if someone discovers your password.

Regular Updates: Staying Ahead of Potential Vulnerabilities

Just like any other software, cryptocurrency wallets and their underlying technology periodically receive updates and patches to address security vulnerabilities as they are identified. Keeping your wallets updated with the latest security patches is crucial in preventing potential exploits by malicious actors seeking to exploit known weaknesses.

Updating your wallets not only ensures that you have access to the latest security features but also serves as a proactive measure against emerging threats. Neglecting these updates may leave you vulnerable to known security flaws that had been addressed in recent versions.

By leveraging these security measures, you can significantly enhance the protection of your cryptocurrency funds, securing them from potential threats and maintaining peace of mind in this dynamic digital landscape.

Ensuring comprehensive security for your cryptocurrency involves more than just safeguarding private keys; it also entails diversifying security with different key types. Let’s unravel how alternate key types can fortify your cryptocurrency holdings against potential risks.

Diversifying Security with Different Key Types

When it comes to your cryptocurrency security, one size doesn’t fit all. Just like you wouldn’t rely on a single lock to guard everything you own, it’s essential to diversify your security measures with different key types. This isn’t just about having more keys; it’s about making sure each key serves a unique purpose in bolstering the protection of your digital assets.

One fundamental aspect to understand is the difference between private and public keys. Private keys are intimately personal and serve as a digital signature for blockchain transactions. It’s crucial to keep these private keys secure to maintain control over your crypto holdings. On the other hand, public keys are visible to all users in the network and are used for identification and verification of transactions. This distinction is crucial in understanding how key types work together to safeguard your assets.

To illustrate the importance of this relationship, think of private keys as the key to your front door and public keys as your mailbox with the address visible to everyone. One grants access while the other helps identify where transactions are coming from.

Importance of Diversification

Diversification in key types adds layers of security, reducing the risk of unauthorised account access or hacking. Much like having multiple locks on different entryways to a building, using various key types makes it increasingly difficult for bad actors to compromise your cryptocurrency holdings.

By employing different types of keys within your wallets, each with its unique role and use case, you create a multi-faceted defence system for your digital assets. This multi-layered approach acts as a robust deterrent against potential cyber threats and unauthorised breaches.

An analogy can help clarify this concept further: Imagine combining fingerprint recognition, a password, and a physical key as access requirements for a high-security vault. Each layer offers a distinct level of protection, making it arduous for an intruder to bypass all security measures.

With an understanding of this crucial principle, let’s move forward to explore the different types of key options available and how they contribute to fortifying cryptocurrency security.

In-depth Look at Advanced Private Key Features

When it comes to safeguarding something as valuable as your digital assets, going the extra mile is crucial. Advanced private key features not only add layers of protection but also provide methods for recovery and secure storage. Let’s start by exploring the concept of backup phrases.

Backup Phrases: A Lifeline for Your Private Keys

Imagine having the ability to recreate access to your digital assets in case your original private key is lost or compromised. That’s where backup phrases come in. These phrases consist of a sequence of 12 to 24 words that hold the power to regenerate your private key. It’s like a safety net that can rescue you from potential loss or unauthorised access.

These backup phrases play a critical role in safeguarding your digital assets, acting as a last line of defence against unexpected mishaps.

For instance, if your hardware wallet containing the original private key gets damaged or lost, having the backup phrase allows you to restore access to your assets on a new device. This can be a lifesaving feature when dealing with the unpredictable nature of digital assets.

Secure Storage Options for Private Keys

Aside from having a backup plan, it’s equally important to consider the physical storage of your private keys. The more secure and inaccessible your keys are, the less likely they are to fall into the wrong hands. This is where solutions like CRYPTOTAG and bank lockers come into play.

CRYPTOTAG: CRYPTOTAG is a specialised solution designed to provide unparalleled security for storing private keys. It involves engraving private key details onto titanium plates using fire and hammer, making it virtually indestructible and tamper-proof.

Bank Lockers: Bank lockers offer a high level of physical security, protecting your private keys from theft or damage. Placing your private keys in a bank locker ensures that they are stored in a location with robust security measures and surveillance, minimising the risk of unauthorised access significantly.

Understanding and implementing advanced private key features not only fortifies the security of your digital assets but also equips you with reliable recovery mechanisms and secure storage options, essential for navigating the evolving landscape of cryptocurrency security.

Now, let’s delve into robust practises for safeguarding private keys, ensuring that your crypto holdings remain impervious to potential threats.

Robust Practises for Private Key Protection

Protecting your private keys is akin to guarding a treasure chest. If someone pilfers the key to your treasure chest, they can abscond with all your gold – or in this instance, your digital assets. Therefore, we need to be cautious pirates, safeguarding our map to the treasure.

To do this, ensure that you keep your backup phrases safe and accessible. However, refrain from leaving them out in the open where prying eyes can spot them—anyone who gets hold of these special words can purloin your digital coins! It’s similar to possessing a secret code to unlock your treasure chest; you wouldn’t want to disclose it to everyone.

But what exactly are backup phrases? They are a set of 12 or 24 unique words designed to act as a protective shield for your private keys. Much like a spare key could spare you from being locked out of your house, these phrases will rescue you if you lose access to your wallet.

Furthermore, avoid sharing your private keys or these backup phrases with anyone else. Contemplate it this way: Would you openly flaunt your bank account information in public? I presume not. That’s precisely why it is imperative to guard this kind of information closely. In the realm of cryptocurrencies, once someone gains access to these details, they wield complete control over those digital coins.

Similar to any online activity, regularly updating security protocols is crucial for defending against emerging threats in the cryptocurrency space. Just as you would lock your doors and windows and instal a reliable alarm system at home, regularly updating security measures adds an extra layer of protective shields around your digital assets.

Remember, storing private keys securely is vital to safeguard sensitive information and ascertain data confidentiality, integrity, and authenticity. Best practises for private key storage include using hardware security modules such as USB Tokens, Smart Cards, or Hardware Security Modules (HSM), providing an impenetrable way to store private keys. Additional safety measures encompass using a Trusted Key Management System (KMS) for secure storage and management of cryptographic keys and encrypting the private key using a robust algorithm like AES (Advanced Encryption Standard).

By diligently adhering to these practises and remaining abreast of emerging threats in the cryptocurrency realm, you’ll substantially diminish the risk associated with a compromised private key.

In conclusion, prioritising the protection of your private key is fundamental in ensuring the security and integrity of your digital assets. By implementing robust practises and staying vigilant against potential threats, you can fortify your defences in the ever-evolving landscape of cryptocurrency security.

This Post was Last Updated On: March 17, 2024

Download: Educational Guides on Wallets and Private Keys: Enhance Your Cryptocurrency Security Free Latest Version 2024

Technical Specifications

Title: Educational Guides on Wallets and Private Keys: Enhance Your Cryptocurrency Security

Requirements: Windows 11 / 10 / 8 / 7 PC.

Language: English, German, French, Spanish, Italian, Japanese, Polish, Chinese, Arabic, and more

License: Free

Updated: 2024

Author: Official Author Website

Download tags: #Educational #Guides #Wallets #Private #Keys #Enhance #Cryptocurrency #Security

Table of Contents Download